Is a Meltdown Coming?

By Andy Cruz

There seems to be a lot of talk recently about the state of the real estate market and whether or not we will see a collapse coming up soon. While there are many variables that can indicate the cause of a collapse, let’s take a look at the comparison from the last real estate meltdown to now and identify if there are any parallels.

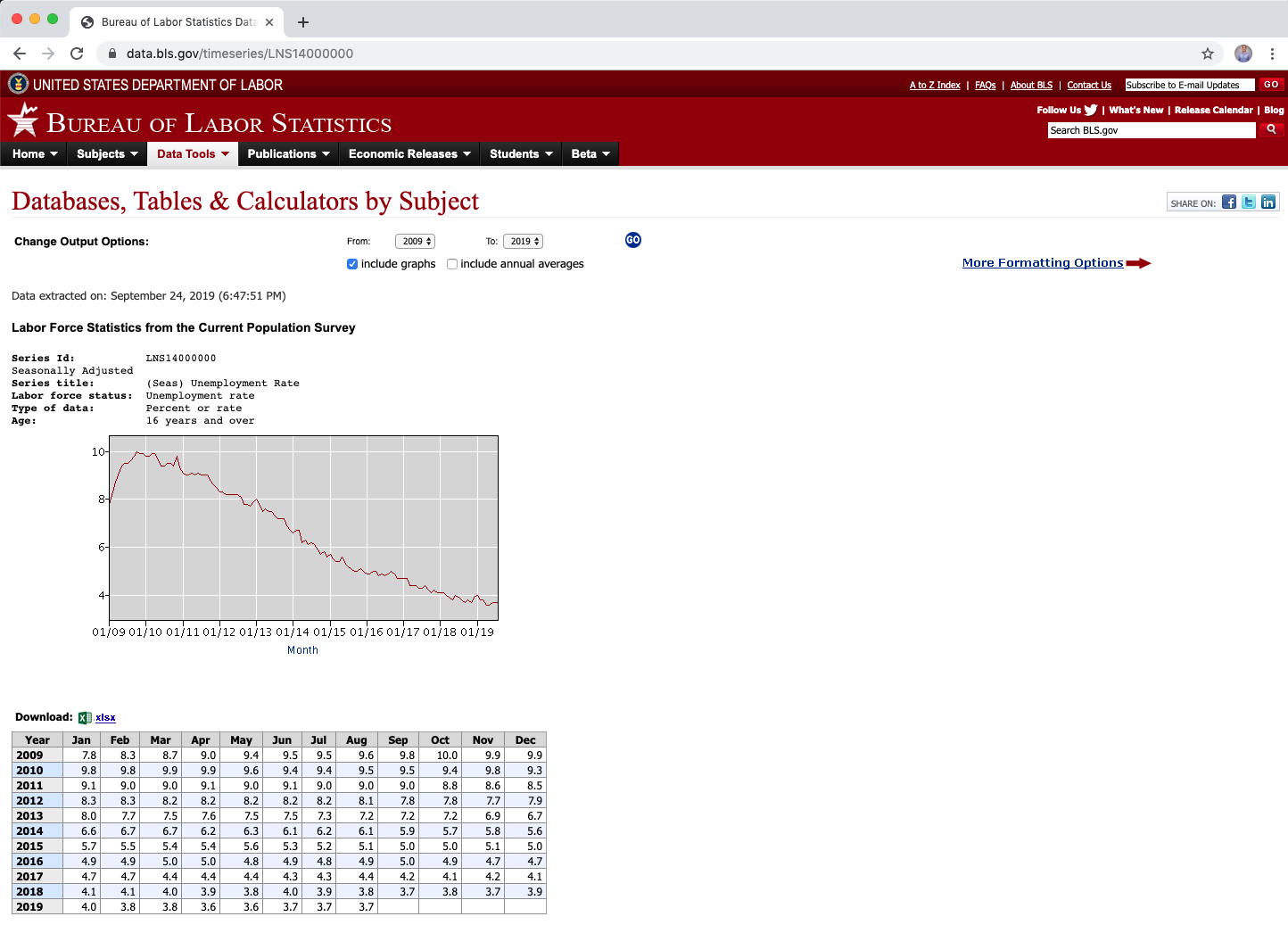

First, let’s look at unemployment in 2009. Unemployment hit a peak of 10% and also had eight additional months of 9% or more unemployment, which continued in 2010 AND 2011. That is a huge percentage of our workforce on the sidelines for a very long time. Currently, unemployment has been at 4% or less for the last eight months. Additionally, we have not had a single month of unemployment higher than 5% in the past 3 years. You have to go all the way back to November of 2015 to find a month where unemployment was 5.1%. November 2015 could signify the “end” of the recovery from an unemployment perceptive. Numbers-only analysis suggests it’s been smooth sailing since then. And, as history would have it, if there is to be in uptick in unemployment, it won’t happen overnight, and it would be due to a variety of variables converging into a perfect storm.

Why does unemployment matter?

When your source of income vanishes, every monthly expense becomes threatened. The largest monthly expense for Americans is their housing expense. For homeowners who make a mortgage payment, taxes, insurance, and HOA monthly this adds up quickly and when they are unable to make payments ontime our default rates increase, and we start to see an increase of foreclosure activity. So it’s safe to say that while unemployment is low, we should expect to see default rates remain low.

Second, we should look at the percentage of homes which are upside down, or what we call negative equity position. Back in 2009, 23% of homes were upside down, and today it is only 3.8% of homes. We should first understand that there will always be a segment of our population that gets trapped in declining house prices in their specific market and the fact that this is the lowest number we’ve seen in the last few decades tells us something: People are not overleveraging their real estate equity, and values are healthy. This also means, homeowners are not taking as much cash out of their real estate as they could. Whether it’s tighter underwriting guidelines, lack of need, or pure financial discipline, the data suggests that homeowners are for the most part settled in and happy with the amount of equity they have and do not wish to become “house rich, cash-out poor”.

Why does Negative Equity Matter?

Homeowners who owe more debt on the house than it’s worth are typically discouraged. While negative equity doesn’t reflect their ability to make the monthly payments, it triggers homeowners to entertain the notion of “what will happen if I just stop paying because I want to, even if I can still afford the payments?” Of course, the risks are ruining your credit, getting behind on payments, etc… which only makes matters worse down the road. If your end goal is to remain in your home, then it’s in your best interest to keep paying while the local market goes through its correction and values surpass the mortgage balance owed. If the percentage of homes in negative equity position increases, expect to see a correlation in sliding real estate values in major metropolitan cities along with an increase of overall mortgage debt.

In summary:

- There will always be a small segment of our population which at any given time is unemployed, under employed, or in transition between jobs. Historically this is measured as 3% of the workforce. If current unemployment at 3.7% now, make a mental note that 3.0% is the aforementioned group, and 0.7% is “actually” without work and without monthly income (even unemployment pay).

- There will always be people who are upside down in their homes or in default because of circumstances beyond their control. This could be things like underemployment, death of an income earning spouse, personal injury, long term illness, etc. During the last real estate meltdown, we had an entire banking industry providing mortgages to people who could not afford them, with jobs they would not have for 30 years, for homes that were not worth as much as they were said to be.

- In my opinion the biggest factor that helped create the meltdown was too much lending to too many people without verified income, assets, and ability to repay.

- Since the collapse happened many measures have been put into place to ensure that the marketplace requires borrowers to provide documentation of their ability to repay the mortgage they are applying for. This has resulted in an increased percentage of homeowners who can actually afford their home, because they qualified with documented income whereas before we had people stating their income, whether or not they had long term employment secured or not.

While economics can paint a much different picture depending on the data you look at, the data that caused the last collapse is 2009 is vastly different than the numbers we’re seeing today.

Be careful that you do not buy the headlines, buy the data instead. Look at the correlating factors that caused the previous meltdown, and look at the factors that are currently impacting our economy today. Will a real estate pullback happen? Yes, it will. But the real pressure on our economy seems to be the almighty dollar, and the consumers ability to purchase goods and services at a reasonable cost. With minor inflation and international trade tensions locked up, it almost guarantees we will see increased prices of goods, which are imported here to the United States, which decreases our consumer buying power. If decreased consumer buying power continues for too long, and in too many parts of our overall economy, then the same dollars we use to pay our mortgages will be vying for groceries, gas, household goods, healthcare, dinners out, movies, and other discretionary spending. Something has to give.

In the end, everyone needs to have a roof over their head, but that does not mean that they have to own a house. Housing solutions such as renting, or combined family housing are 2 commonly used approaches. As daily necessities increase in cost such as food, clothing, utilities, society tends to get more creative with their housing solutions. So the largest single threat to future real estate pullback might just be in the lifestyle choices we make which negatively impact the industry. Here’s what I’ll be watching:

- Millennials real estate ownership statistics – What percentage of this demographic are buying homes? And is that number increasing or decreasing?

- Baby boomers moving to retire – Where are they going in droves? And what are they doing with their sales proceeds from their real estate sold?

- Affordability Index – We can’t buy what we can’t afford, sometimes this means we don’t own a home.

For those of you Super Nerds wondering why the banks and Wall Street haven’t been mentioned in this article as a reason to blame for the last collapse…well that’s a whole‘nother topic, see you next week 😉