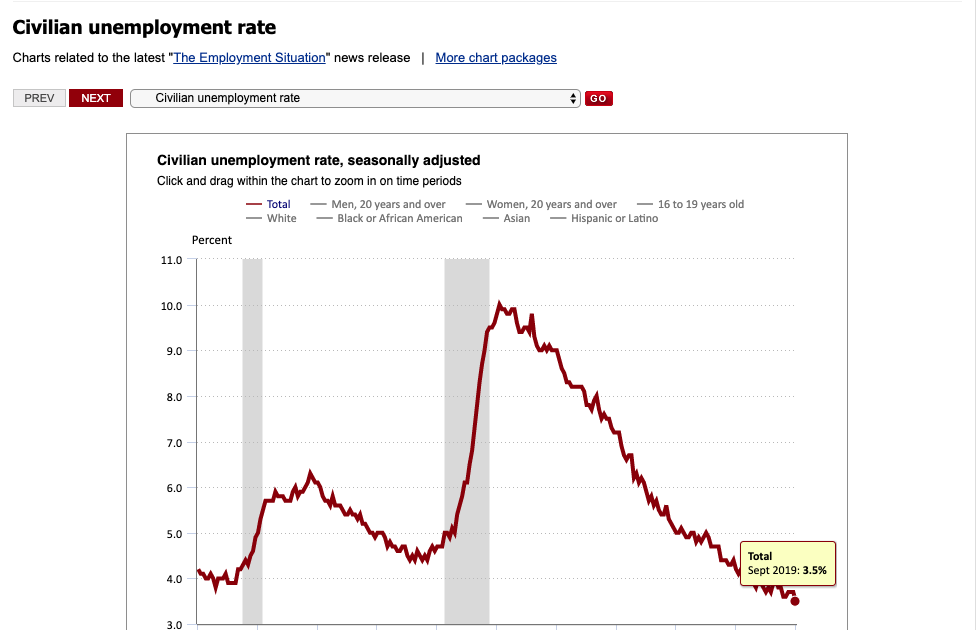

3.5% an all new low for Unemployment

By Andy Cruz

Well the unemployment data does it again! With September’s data being released last week we seem to have reached a new low…a 50-Year low that is! The Bureau of Labor and Statistics released their most recent findings which show unemployment at its lowest in the last 50 years: 3.5%

Well the unemployment data does it again! With September’s data being released last week we seem to have reached a new low…a 50-Year low that is! The Bureau of Labor and Statistics released their most recent findings which show unemployment at its lowest in the last 50 years: 3.5%

This number is significant for many reasons, but for the purposes of this article, I will discuss the direct correlation this has to the mortgage market.

- This is “Hard Data” meaning this figure is measured without feeling involved. “Soft Data” like sentiment, and consumer confidence are finicky at best and not always the most accurate to reflect the health (or illness) of an economy. Hard data is more of an indicator of what mortgages will do than soft data.

- 5% unemployment means our workforce is vastly employed which indicates we can expect low vacancy rates in rentals and increased home purchase applications. “Affordability” will still remain an issue; however, it’s at least an issue with some options whereas unemployed leaves no options when it comes to lending.

- Owners who are in default, pre-foreclosure or foreclosure may climb their way out of that ditch. While this is a very small number of folks out there, it is still a reality for some people. When homeowners are unemployed, they have to rely on personal savings to make ends meet, and most often this is when we start to see and uptick in default rates. Regaining income allows for a homeowner to take a fresh approach with their lender while in the default stages in order to craft a workout solution and give hope that the late payments can eventually be rectified.

- Owners who were unemployed for a short period of time and have regained full time employment will find themselves able to pursue a rate & term refinance, or even a cash out refinance as long as their home equity, personal credit and debt-to-income ratios are in check. This opens up monthly savings opportunities to further prevent potential default, and in the case of cash out, this may allow them to pay down other consumer debt that may have amounted while on the job hunt.

At Mortgage Heroes we understand these are not the end-all-be-all for every homeowner. We offer this opinion to shed light on how real data impacts the mortgage industry at the bank level and at the homeowner level. If you are in a position where you have recently gained, or re-gained, full time employment, please reach out to us so we can help you secure a home of your dreams.

For those of you that live here in San Diego, it is imperative to take a look at your home’s value to determine how much equity you might have in the market right now. This could lead to a sale decision or even a refinance decision to better your overall financial picture for the long run. If you do not know the value of your home, you can click here and sign up for our reports with local market data specific to your address. If you have been kicking around the idea of refinancing to lower your rate, lower your monthly payment, pay off debt, reduce your loan term or for any other reason, we can at least have a strategic conversation to help you decide whether you should proceed or not. Please let us know how we can help you.